StormYield is a global financial company that offers an alternative to traditional finance and fiat currencies. StormYield is a decentralized platform built on top of the Ethereum blockchain, with the aim of providing secure and transparent financial transactions to anyone on the planet. StormYield is a 100% decentralized platform. Decentralization is an important part of the StormYield Platform. Our platform offers users the possibility to be part of the platform and benefit from it. We are a platform that is working hard to innovate in the world of finance by providing a decentralized platform that does not depend on third parties. StormYield envisions a world where people are free from the control of financial institutions. We want to offer a decentralized, transparent and fair financial platform.

StormYield is a platform that facilitates the interaction of financial markets and cryptocurrency markets. The platform will allow users to invest capital in digital assets, cryptocurrencies and digital assets. In addition, the platform will allow users to invest in the capital market through the purchase of tokens. StormYield allows you to invest the money you have in a safe, secure and convenient way. The platform will offer a variety of financial products, including exchange-traded funds, futures and options. StormYield is a decentralized financial ecosystem where all participants are incentivized to contribute to the long-term success of the Platform.

Auto pairing

$STY is the native token of the STY Protocol. With Crypto's highest paying Auto-Staking & Auto-Compound protocol and APY remains the industry's largest at 669,212.62%, all BSC wallets with $STY tokens receive an automatic compound interest reward movement every 5 minutes.

STY. Insurance Fund

SIF acts as an Insurance fund that always pays back a base rate of 0.00838% to all $STY holders every 5 minutes to ensure price continuity, avoid booms and drive long term growth of the STY Protocol.

Treasury STY

In the event of a sharp decline in prices, the Treasury will deposit funds into the Insurance Fund, keeping prices stable and sustainable in the long term. The Treasury also funds the marketing, investment, and future development of the STY Protocol.

Lighting bar

1.5% of all $STY traded is burned on the Lighting Rod. In the same way that a real-life lightning rod eliminates the threat from lightning, the STY Lighting Rod protects the STY protocol by reducing the cyclic supply, thereby denying active interest in the base. back and keep the protocol ongoing.

STY Automatic Liquidity Tool

Automatically pumps liquidity every 48 hours

Enable complete APY persistence until maximum supply is reached

Team cannot pause or prevent Liquidity from being

The eco-friendly STY DAO

What are DAOs?

A decentralized autonomous organization (DAO) is an organization designed to be automated and decentralized. They operate as a type of venture capital fund, based on open source code and without a centralized management structure.

All organizational transactions are recorded and maintained on the blockchain. It is in the interests of DAO members - if properly respected - to be heard and acted upon. Therefore, DAOs are transparent and, in theory, indestructible. All organizational transactions are recorded and maintained on the blockchain.

The eco-friendly STY DAO

What are DAOs?

A decentralized autonomous organization (DAO) is an organization designed to be automated and decentralized. They operate as a type of venture capital fund, based on open source code and without a centralized management structure.

All organizational transactions are recorded and maintained on the blockchain. It is in the interests of DAO members - if properly respected - to be heard and acted upon. Therefore, DAOs are transparent and, in theory, indestructible. All organizational transactions are recorded and maintained on the blockchain.

Set APY. calculation "Compound interest is the most powerful force in the universe." - Albert Einstein APY stands for Annual Percentage Rate. It measures the real rate of return on your principal taking into account the compounding effect. In StormYield Finance, the $STU token represents your principal and compound interest is added periodically to each Rebase event (every 5 minutes). Simple formula and interest calculation: A = Final Investment Value, using the simple interest formula: A = P (1 + rt) where P is Principal Amount Invested at R% Interest Per Period for t Number of Periods. Where r is in decimal form; r = R / 100; r and t in the same unit of time. The cumulative amount of an investment is the initial principal P plus the accumulated simple interest, I = Prt, so we get: A = P + I = P + (Prt),

STY Tokenomics $STY token is native in Storm Yield Finance to reward owners every 05 minutes.

STY TOKEN DISTRIBUTION: Initial Supply: 400,000 Max Supply: 5,000,000,000 Fairlaunch: 240,000 Liquidity: 122,400

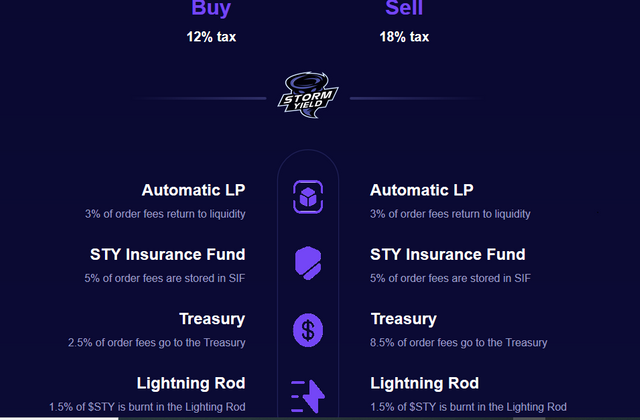

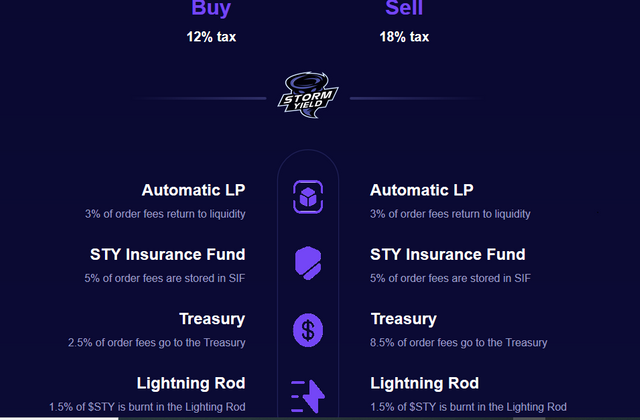

Trading Fee Explain: Buy: 12% tax Auto LP: 3% of order fee back to liquidity STY Insurance Fund: 5% of order fee held in SIF Treasury: 2.5% of order fee go to Treasury Lightning Rod: 1.5 % of $STY burned on Lighting Rod Sell: 18% tax Auto LP: 3% of order fee back to liquidity STY Insurance Fund: 5% of order fee held in SIF Treasury: 8.5% of order fee goes to Treasury Lightning Rod : 1.5% of $STY burned on the Lighting Rod

Follow Them On This Link: Website: https://stormyield.finance/ Telegram: https://t.me/stormyieldglobalchat Twitter: https://twitter.com/stormyield Discord: https://discord.com/invite / Q9WAauv78v Whitepaper: https://stormyield.finance/#Whitepaper

Distribution of STY tokens:

- Initial Supply: 400,000

- Max Supply: 5,000,000,000

- Fair Launch: 240,000

- Liquidity: 122,400

Trading Fees Explain:

Buy: 12% tax

- Auto LP: 3% of order fee back to liquidity

- STY Insurance Fund: 5% of the booking fee is deposited in SIF

- Treasury: 2.5% of the order fee goes to Treasury

- Lightning Rod: 1.5% of $STY burned in Lightning Rod

Selling: 18% tax

- Auto LP: 3% of order fee back to liquidity

- STY Insurance Fund: 5% of the booking fee is deposited in SIF

- Treasury: 8.5% of the order fee goes to Treasury

- Lightning Rod: 1.5% of $STY burned in Lightning Rod

I am the best, I am what I have 50/50

However, you can't get a good price if there isn't enough liquid in the pool. Therefore, the STY team designed the STY Auto-Liquidity Engine (SALE) to automatically add more liquid to the original liquidity pool.

Long Term Interest Cycle (LIC)

In order to maintain sustainable Aid Growth in the future, RZA Finanse has introduced a very Long Term Interest Cwsle (LIC) feature, which allows holders of $RZAẑ tokens to allow multiple rerretual interest.

Each rate cycle is 5 minutes long and is called EPOCH.

There are 105,120 epochs in a year.

EPOCH 1105120: 0.00838% for each EPOCH (12 months first)

EPOCH 105120-157680: 0.00066% for each EPOCH (6 months later)

EPOCH 157680: 0.00006% for each EPOCH (ongoing, until supply maximum reached)

Certification audit

5,000

token holders 10,000 token holders

15,000

STY DAO token holders (in May)

20,000

token holders 50,000 token holders

To learn more about the

by yufiezz

link https://bitcointalk.org/index.php?action=profile;u=2979093

Ulasan

Catat Ulasan